SuiteWorld 2024 Demo: Payroll Garnishment

SuiteWorld 2024 served as the perfect platform to showcase our upcoming features to customers and industry stakeholders. Leadership prioritized solutions for three key tasks within the garnishment domain, focusing specifically on Federal Tax Levy due to its high demand and simpler calculations compared to other garnishments like Child Support. With a tight two-month timeline, our challenge was to research, design, and deliver impactful, user-centric interfaces that would highlight our product’s potential and leave a lasting impression.

Business Need

55% of our payroll customers deal with wage garnishments, yet the process was not adequately supported by existing features. Customers have reportedly requested for a better garnishment solution signalling a clear need for improvement.

Objective

To create a streamlined solution that aligned with customer expectations for the tasks decided by the leadership that would resonate with customers while emphasising our product’s value for SuiteWorld 2024.

Why Federal Tax Levy?

Leadership prioritized releasing the Federal Tax Levy feature due to its relative simplicity compared to other garnishments, such as Child Support. Unlike the latter, Federal Tax Levy involves less complex calculations, making it quicker to design and implement.

Stakeholders

UX Researcher (me)

UX Designer

Product Manager

Dev Team

Timeline

Desk Research

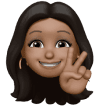

To kick things off, we conducted an initial exploratory study to understand the current landscape and identify key challenges in the existing garnishment process. This gave us a foundation for further analysis.

01

02

03

To identify gaps and opportunities to

differentiate our product, I analyzed competitors

Different types of garnishments supported by competitors

Competitors handle remittance differently: Gusto and ADP automate payments, while OnPay relies on manual checks, and QuickBooks uses third-party services like ExpertPay.

Lack of automated remittance creates inefficiencies and extra workload. Automating remittance payments and integrating directly with government portals could streamline workflows and improve user satisfaction.

Some platforms lack specific garnishment categories, such as regional tax levies or bankruptcy support.

There’s an opportunity to differentiate by offering less common garnishments or providing enhanced visibility and support for these.

Documentation and workflows across providers suggest variability in complexity. Some platforms provide straightforward garnishment setup (e.g., Paylocity), while others require navigating multiple steps or manuals (e.g., OnPay).

Optimise workflows in your product with guided onboarding, pre-filled templates, or visual aids to reduce confusion and save time for users.

Most competitors bundle garnishment features within their core payroll services, while Paychex offers them as an add-on.

Users expect garnishment features to be included in payroll packages, as separating them can create friction during purchasing. Offering advanced features as a premium option could cater to enterprises seeking robust support.

Features like child support, federal tax levy, and student loans are universally offered across all platforms.

These can be considered baseline expectations for any payroll garnishment solution. Your product must deliver these seamlessly to meet market standards.

At this point, we deviated from our path to MVP. The path ahead will lead you to the final demo that was showcased in SuiteWorld. Curious to see how we worked towards MVP? Lets connect!

Lets Connect

With the help of

UX Researcher

UX Designer

Product Manager

Dev Team

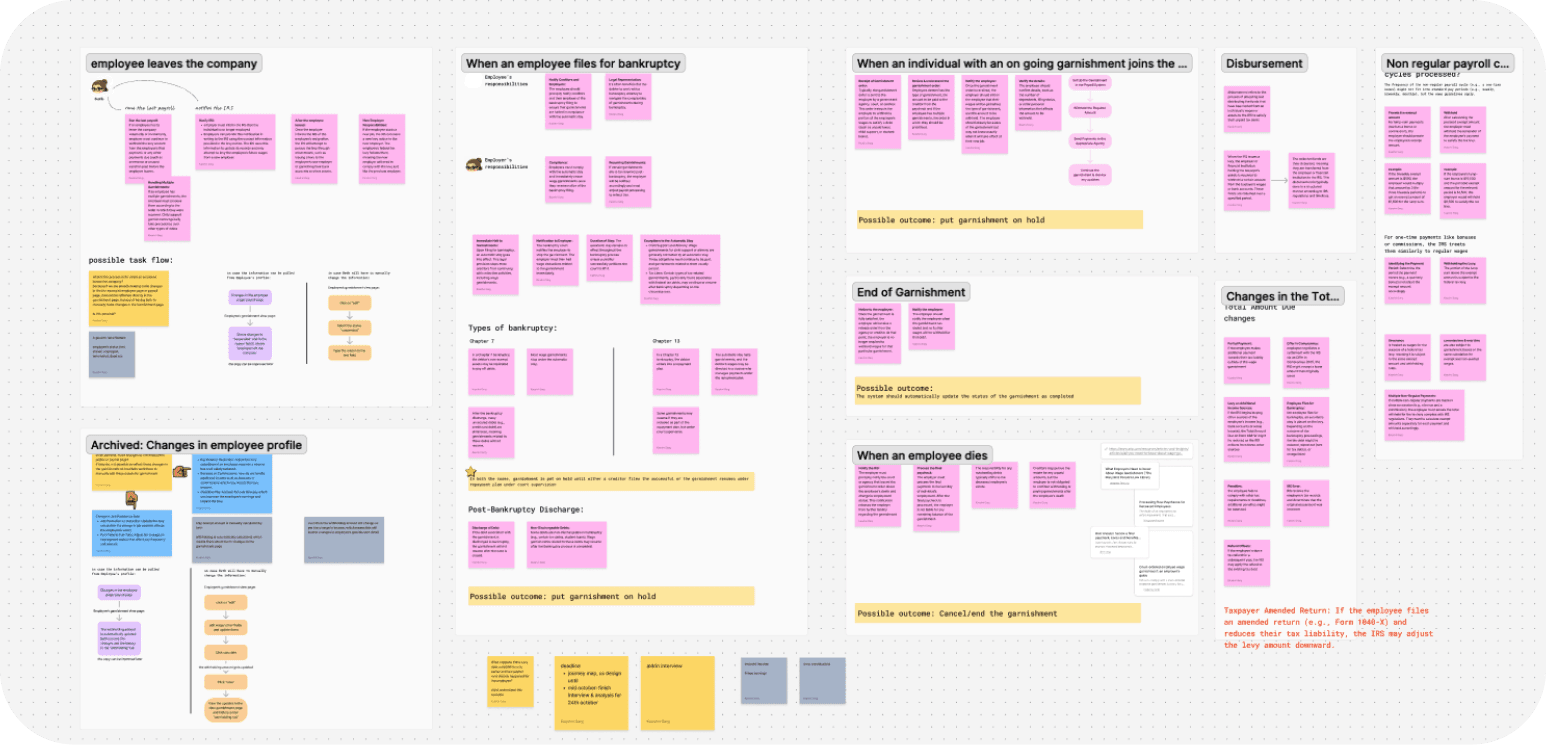

While making the new task flow we recognised the need to talk to customers & understand what THEY wanted. So we involved Design Ops to start the process of recruitment and help set up interviews.